About a year ago, I wrote a blog post titled “The Inflation-Deflation Debate and What It Means for Real Estate Investors.” One of the questions I raised at that time was whether or not consumer price inflation would rise and force the Federal Reserve’s hand in raising interest rates and tightening liquidity. More importantly, if this happened, what could be the potential consequences? We now appear to be at that point so I thought it would be worth revisiting.

No one can argue that we are not currently experiencing significant inflation. Whether it be energy, food, shelter, or services, we are all paying significantly more for things than in the past. The debate, however, remains as to whether these price increases will be relatively transitory, or more permanently imbedded in our future cost structure. The camp arguing that inflation is transitory continues to shrink with each additional CPI release, which happened to come in at 7.5% last week. More and more, it appears the Fed may be behind the curve in containing inflation.

Pressure to take action continues to increase as other central banks around the globe have begun rate-raising cycles. Not too long ago the consensus was for three, or maybe four, rate increases in 2022-2023. Now some are predicting seven increases during 2022, and even the possibility of a 0.50% raise at the March meeting. Public pressure is mounting, and the fact that this is a mid-term election year further complicates the decision-making process. Political polls show inflation as the electorates’ number one concern at the moment and projections do not look favorable for the current majority party. You can expect continued pressure from President Biden and other Democratic leaders on Federal Reserve Chair Jerome Powell to “do something” about inflation. The question in the back of everyone’s mind is: what are the consequences?

The Importance of Yield Curves

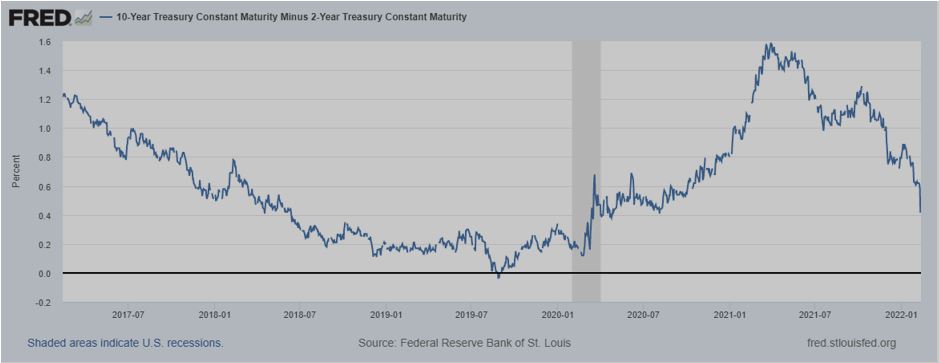

As I touched on last year, because of the fragility of the financial system, the Fed may be in a very difficult position if it is required to fight inflation. I won’t rehash all the reasons for that here, but we are starting to see more indications of this risk materializing. One indication is in what is commonly called the yield curve. Simply put, the yield curve measures the difference in yields of treasuries of different maturities. In a normal environment, short-term debt will yield less than longer term debt, and the yield curve will slope gently up and to the right. However, when a yield curve flattens, and even inverts, it is often cited as an indication that something is wrong in the economy. It is frequently noted as a sign of a looming recession. Recent market activity is showing the yield curve flattening significantly and the spreads between short- and long-term treasuries narrowing. Below is a graph of these spreads for two- and ten-year maturities over the last five years.

How the yield curve reacts over the next few months could be very telling. We have seen pretty significant change early this year as the pressure to raise rates to fight inflation has increased. Short-term rates are up considerably. But what is the long end of the curve trying to tell us? If there is this much pressure building on the short end of the curve where the Fed’s typical actions have more control, the long end might be saying the economy can’t handle it and that the risk of prolonged higher interest rates isn’t going to materialize. Because of the over-indebtedness of the system and its reliance on cheap credit, many think that any significant rise in rates and/or draining of liquidity will force the economy into recession.

Another Dilemma for the Fed

This is the predicament the Fed has created with its prescriptions following the last crisis. It has created a financial structure so dependent on cheap credit and excess liquidity that it cannot fight inflation without destroying the economy. Instead of the financial markets reacting to the economy and its prospects, the financial markets appear to have become the economy. An attempt to drain liquidity from the markets would force the economy into recession. The decreasing spreads back in the 2018-2019 period when the Fed last attempted to “normalize” can be seen in the chart above. Significant cracks resulted in the credit markets as the high-yield markets all but dried up and the repo markets went haywire. It quickly had to reverse course as the economy was showing signs of rolling over and many think the pandemic provided it cover to abandon its change in policy.

Politically, it may be a choice between the number of people affected by inflation (the whole country) or those who own financial assets (a much smaller subset). The discussion between President Biden and Fed Chair Powell regarding the choice between killing inflation or the markets and economy will be an interesting one. Let’s hope that’s not the case and the Fed can find an effective way to navigate a narrowing path between the two. We can hope as supply chains free up and some normalcy is restored to the economy that inflation finds a moderate and tolerable level so that economic growth can continue.

Invest with caution

As real estate investors, we need to be mindful of the potential consequences. Whether it be from killing inflation or the economy, we should expect the outsized rent increases that we have seen in recent years to abate. Over the last year, many national numbers peg percentage rental increases into the high-teens. Remember, going forward, many of these increases are baked into the income numbers presented to purchasers. Will there be a reversion back to a lower level, a plateau with minimal future increases, or continued significant rental inflation? Or have rents reached their upper limit because of a lack of tenants’ disposable income while other operating costs continue to soar? Will the capital improvements budget in the value-add business model be sufficient when lumber and other construction inputs are three or four times higher than they were a couple years ago? What if those value-add rent increases are unattainable because we are already at the upper limit of the rental market range? What would that look like in the proforma?

As passive investors, we need to consider these factors as we vet future deals. Paying attention to sensitivity analyses and break-even occupancies to assess worst-case scenarios will be of utmost importance. Investing with experienced operators who have successfully weathered downturns in the real estate cycle should also be strongly considered.

Tom Borger is a real estate investor and developer in Northern Indiana.

Nothing on this website should be considered financial advice. Investing involves risks which you assume. It is your duty to do your own due diligence. Read all documents and agreements before signing or investing in anything. It is your duty to consult with your own legal, financial and tax advisors regarding any investment.