Glossary of Terms Used in Syndications

A

Accredited investor: a person or a legal entity who is allowed to participate in investments not registered with the U.S. Securities and Exchange Commission. An individual accredited investor is anyone who either earned income of more than $200,000 (or $300,000 together with a spouse) in each of the last two years and reasonably expects to earn the same for the current year, or has a net worth over $1 million, either individually or together with a spouse (excluding the value of a primary residence). (NerdWallet.com)

Analysis paralysis: a situation in which a person is unable to make an investment decision because they overthink and overanalyze the data. This is a common ailment that plagues newbie real estate investors. (Medium.com)

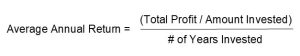

Average annual return: a rate of return metric that is calculated by taking the total profit received and dividing it by the original amount invested and then dividing that by the number of years an investment was held.

This is not to be confused with “annualized total return”, which is the geometric average amount of money earned by an investment each year if the annual return was compounded. (Investopedia.com)

B

Bad debt: in real estate, it is income that is deemed uncollectible from tenants that includes unpaid rent, late fees, pet fees, etc.

Blind pool fund (or private placement real estate fund): a direct participation program or limited partnership that lacks a stated investment goal for the funds that are raised from investors. In a blind pool, money is raised from investors, usually based on the name recognition of a particular individual or firm. They are usually managed by a general partner who has broad discretion to make investments. A blind pool may have some broad stated goals, such as growth or income, or a focus on a specific industry or asset. (Investopedia.com)

Break-even occupancy ratio: the sum of all operating expenses and debt service, divided by the total potential rental income. This tells you what percentage of the property must be leased in order to cover all expenses and debt service obligations. This ratio refers to the economic occupancy and not the physical occupancy. (PropertyMetrics.com)

Bridge loan: short-term commercial real estate loans that are used for the purchase of commercial properties when permanent financing is not an option. Their primary use is when a property needs significant renovation before it will qualify for permanent financing. (FitSmallBusiness.com)

C

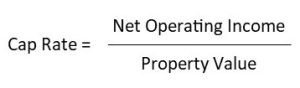

Cap (Capitalization) rate: the rate of return expected to be generated from the all-cash (i.e. no leverage) purchase of a property. It is calculated by taking the net operating income (NOI) and dividing it by the asset value. (CREPedia.com)

CapEx (Capital Expenditures): money used to add to or improve a property beyond common repairs and maintenance, such as replacing a roof or windows, paving a parking lot, or buying major appliances. (Fool.com)

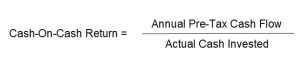

Cash-on-cash return: a percentage that measures the pre-tax cash flow relative to the money invested in an asset. It is calculated by taking the net operating income and dividing it by the total cash investment. (BiggerPockets.com)

CMBS loan: commercial mortgage-backed securities, or conduit loans, that are used to purchase commercial real estate buildings and are typically non-recourse and fully assumable. The minimum loan amounts are higher than for agency loans. (Fool.com)

Concessions: an incentive or discount given to a tenant by a landlord to make a lease more enticing. (CREPedia.com)

Cost segregation study: a tax strategy that allows real estate owners to utilize accelerated depreciation deductions to increase cash flow, and reduce the federal and state income taxes they pay on their rental income. (TheRealEstateCPA.com)

D

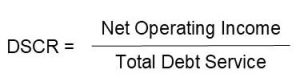

DCR (Debt Coverage Ratio) / DSCR (Debt Service Coverage Ratio): In the context of corporate finance, the debt-service coverage ratio (DSCR) is a measurement of a firm’s available cash flow to pay current debt obligations. In the context of personal finance, it is a ratio used by bank loan officers to determine income property loans. (Investopedia.com)

Depreciation: an important tool for rental property owners that allows them to deduct the costs from taxes of buying and improving a property over its useful life, and thus lowers their taxable income in the process. (Investopedia.com)

Due diligence: the use of reasonable care in an investigation of the relevant facts, assumptions, parties, conditions and subject matter pertinent to a transaction. In a real estate transaction, due diligence would include an investigation into the ability of the parties involved to conclude the transaction, a confirmation of the market and financial assumptions underwriting the property, an investigation into the condition of the subject property, and the fitness or regulatory restrictions applicable to the subject property’s intended use. (CREPedia.com)

E

Economic vacancy: the difference between the actual rental income and the gross potential rent of a property. This includes several other factors, such as tenants that have not paid rent, units that are occupied by a property manager or are otherwise “given” away, turnover periods between tenants, and rental incentives, such as a free month of rent or a percentage-based rental discount. (CommercialRealEstate.loans)

Effective Gross Income (EGI): the actual amount of income that a rental property is expected to generate. It is the total income expected from all operations of the rental property after an allowance is made for the revenue that is lost from vacancy or unpaid rents. (MashVisor.com)

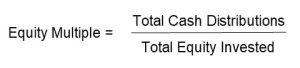

Equity multiple: the total cash distributions received from an investment, divided by the total equity invested. Essentially, it’s how much money an investor could make on their initial investment. An equity multiple less than 1.0x means you are getting back less cash than you invested. An equity multiple greater than 1.0x means you are getting back more cash than you invested. (Crowdstreet.com)

Executive summary: a syndication’s marketing packet discussing the particulars of a real estate investment. No two look the same but all will include an overview of investment including photos, detailed metrics and forecasted numbers, the business plan, and information on the management team.

Expense ratio: a measurement of the cost to operate a piece of property, compared to the income brought in by the property. It is calculated by dividing a property’s operating expense (minus depreciation) by its gross operating income. (Investopedia.com)

G

GP (General Partner): A real estate limited partnership (RELP) is a group of investors who pool their money to invest in property purchasing, development, or leasing. Under its limited partnership status, a RELP has a general partner who assumes full liability and limited partners who are liable only up to the amount they contribute. The general partner is usually a corporation, an experienced property manager, or a real estate development firm. The limited partners are outside investors who provide financing in exchange for an investment return. (Investopedia.com)

I

IRR (Internal Rate of Return): a metric used to measure the potential return of an investment. The IRR is the rate of growth an investment is expected to generate annually which will most likely differ over the life of the deal. (Investopedia.com)

IRR partitioning: breaks down the cash flow of the internal rate of return into its two components – cash flow from the operations of the asset (i.e. rent) and capital gains from its sale. The importance of this metric is to help assess the level of investment risk. Cash flow from rental income is more predictable because of the past earnings history. The expected cash flow from the sale is less certain because the exit cap rate can vary significantly in 3 to 10 years when the sponsor decides to sell. (Property-Investment.net)

L

LLC (Limited Liability Company): a limited liability company (LLC) is a business structure whereby the owners are not personally liable for the company’s debts or liabilities. Limited liability companies are hybrid entities that combine the characteristics of a corporation with those of a partnership or sole proprietorship. (Investopedia.com)

Loss to lease (LTL): the difference between a property or unit’s market lease rate and the actual lease rate. Usually, this lost income comes in the form of an incentive, such as a free month of rent, to encourage potential tenants to sign a 6- or 12-month lease. (PropertyMetrics.com)

LP (Limited Partnership): a partnership made up of two or more partners. The general partner oversees and runs the business while limited partners do not partake in managing the business. However, the general partner has unlimited liability for the debt, and any limited partners have limited liability up to the amount of their investment. (Investopedia.com)

LTV (Loan-To-Value): an often used ratio in mortgage lending to determine the amount necessary to put in a down-payment and whether a lender will extend credit to a borrower. (Investopedia.com)

M

Managing member: a managing member is a person who is involved in the daily management of a company (usually a limited liability company). The managing member has an interest in the business as an owner. This person is also in an authoritative position that allows him or her to represent the company in contract negotiations and agree to the terms of a binding contract. (UpCounsel.com)

N

NOI (Net Operating Income): a calculation used to analyze the profitability of income-generating real estate investments. NOI equals all revenue from the property, minus all reasonably necessary operating expenses.

NOI = Real Estate Revenue – Operating Expenses

NOI is a before-tax figure, appearing on a property’s income and cash flow statement, that excludes principal and interest payments on loans, capital expenditures, depreciation, and amortization. When this metric is used in other industries, it is referred to as “EBIT”, which stands for “earnings before interest and taxes”. (Investopedia.com)

Non-accredited investor: any investor who does not meet the income or net worth requirements set out by the Securities and Exchange Commission (SEC) [see Accredited Investor]. In Rule 506(b) of Regulation D, private offerings are restricted to an unlimited number of accredited investors and a limited number of non-accredited, sophisticated investors, defined as those investors with sufficient knowledge and experience in financial and business matters to make them capable of evaluating the merits and risks of the prospective investment. (Investopedia.com)

Non-recourse loan: a loan where, in the case of default, a lender can seize the loan collateral, but, in contrast to a recourse loan, the lender cannot go after the borrower’s other assets—even if the market value of the collateral is less than the outstanding debt. (Forbes.com)

Non-revenue units: units that do not produce any sort of income – e.g. employee units (for the property staff/managers) and model units (for showing prospective tenants). (TSMFinancialModels.com)

NNN (Triple net) lease: a lease agreement on a property whereby the tenant or lessee promises to pay all the expenses of the property including real estate taxes, building insurance, and maintenance. These payments are in addition to the fees for rent and utilities, and all payments are typically the responsibility of the landlord in the absence of a triple, double, or single net lease. (Investopedia.com)

NPV (Net Present Value): the difference between the present value of cash inflows and the present value of cash outflows over a period of time. NPV is used in capital budgeting and investment planning to analyze the profitability of a projected investment or project. (Investopedia.com)

O

Operating agreement: a document that customizes the terms of a limited liability company according to the specific needs of its owners. It also outlines the financial and functional decision-making in a structured manner. It is similar to articles of incorporation that govern the operations of a corporation. (Investopedia.com)

Operator: the team (usually a company) that are experts at analyzing markets and deals. They select the property, do the underwriting on a deal to determine if the asset should be acquired, and can make themselves and the investors a good return for the given risk. Operators develop a business plan to add value (optimize the asset) by managing all aspects of the plan. In addition, they have an asset management role to oversee the project for the hold period to ensure the property gets optimized and increases in income and value by their efforts. (ThompsonInvesting.com)

P

Pref (Preferred return): refers to the order in which profits from a real estate project are distributed to investors. Preferred return indicates a contractual entitlement to distributions of profit. The priority of this distribution is maintained until a predetermined threshold rate of return has been met. Once met, profit distributions are made to any other subordinate stakeholders in the project. (EquityMultiple.com)

PPM (Private Placement (or Offering) Memorandum): a legal document that states the objectives, risks, and terms of an investment. This document includes items such as a company’s financial statements, management biographies, and a detailed description of the business operations. The PPM/OM serves to provide buyers with information on the offering and to protect the sellers from the liability associated with selling unregistered securities. (Investopedia.com)

Pro forma: a method of calculating financial results using certain projections or presumptions. (Investopedia.com)

Promote (Promoted interest): a sponsor’s share of profits (separate from the syndication fees) that is significantly greater than the sponsor’s capital investment. The promote is generally given in exchange for the sponsor’s having created value through finding and managing the opportunity, and in some cases for bearing a disproportionate share of the downside risk. (RealtyMogul.com)

R

REIT (Real Estate Investment Trust): a company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors. This makes it possible for individual investors to earn dividends from real estate investments – without having to buy, manage, or finance any properties themselves. (Investopedia.com)

RUBS (Ratio Utility Billing System): a method of calculating a resident’s utility bill based on specific factors such as occupancy rate or apartment square footage and then billing the tenant for their share of utility use. (AdventuresInCRE.com)

S

Sponsor: the person or team that champions all aspects of a commercial real estate project on behalf of the equity investors. In a limited partnership (LP), the sponsor is often referred to as the General Partner (GP), whereas the rest of the investors are Limited Partners (LPs). (AlphaInvesting.com)

Subscription agreement: an investor’s application to join a limited partnership. It is also a two-way guarantee between a company and a subscriber. The company agrees to sell a certain number of shares at a specific price, and in return, the subscriber promises to buy the shares at the predetermined price. (Investopedia.com)

Syndication: a technique for aggregating capital for an investment where multiple owners acquire an equity share in an entity that owns the investment asset. (CREPedia.com)

V

Value-add real estate: a property that requires some improvements in order to increase its value. Such investment properties can be rundown due to the owners lacking the finances to make improvements or just sheer neglect. Investors can buy such distressed or value add properties at a price below market value and make structural, physical, and operational improvements. This will help attract new tenants, reduce vacancy rates, and generate higher rents. (Mashvisor.com)

W

Waterfall: property describes how money is paid, when it is paid, and to whom it is paid in commercial real estate equity investments. Distributions from cash flow and distributions from a capital event (i.e. a refinance or sale) of the investment property are allocated to the General Partners (GPs) and Limited Partners (LPs), primarily based upon the roles they play in a real estate transaction. (RealtyMogul.com)

Y

Yield on Cost: the net operating income (or sometimes cash flow from operations) at stabilization divided by the total project cost, whereas the capitalization rate (cap rate) is the stabilized net operating income (or sometimes cash flow from operations) divided by the market value of the property (AdventureInCRE.com)