Agricultural land isn’t a commonly discussed asset class, but that doesn’t mean it’s not valuable. Many investors are betting on the increased value, and profit, that farmlands will bring. In this episode, Jim Pfeifer talks farmland and everything in between with the cofounder and CEO of Farmfundr, Brandon Silveira. Brandon gets into the nuts and bolts of investing in agricultural land, how to add value to your investment, and finding the right crops to support. Want to learn more about investing in farmland? Then tune in for more!

—

Listen to the podcast here:

Investing In Agricultural Land With Brandon Silveira

I’m pleased to have Brandon Silveira with me. He’s the CEO of the crowdfunding website, FarmFundr. He’s a fourth-generation farmer and real estate investor who’s bought and sold millions in real estate. He currently manages over $100 billion in assets. His specialty is farm management, land acquisition, and a variety of farm and financing strategies. His passion is to bridge the gap between farmland and investors, which is exactly what we are looking for here. Brandon, welcome the show.

Thanks for having me.

The way I like to get started generally is just to hear your journey. I understand you are a farmer from way back. How did you get into crowdfunding and real estate and that whole side of things? If you can tell us about your journey, we would love to know about it.

My family started in the early 1900s dairy farming, milking cows. As we’ve got older, my dad dabbled a little bit in farming. We did some farming for other people. I went off to Cal Poly to get an Agricultural degree. Farming is what I had my blood and passion for and what I wanted to do. When I came back, I started farming, doing work for other farmers, slowly started buying farmland, leasing farmland, and buying and selling, building the farm up.

I’ve got into the crowdfunding side of things because I saw this need for more capital and agricultural in this asset. Investors really wanted to invest in farmland and specific farms but didn’t have a vehicle to do so. This came to me probably in 2006. I didn’t start building the side out until 2015. Once we’ve got some changes for the JOBS Act, and we were able to crowdfund this type of asset, which was a game-changer. It all, believe it or not, takes a slow time before everything morphed into what it is. That’s the background.

What is it now? Can you talk not only about what crowdfunding is? Our community, Left Field Investors, are typically talks about syndications. Crowdfunding is very similar but it’s just maybe on the internet and smaller investment amounts. What else can you explain about how crowdfunding is different than the typical syndication?

We run under Crowdfunding Laws and Regulations, which means the particular rules that we follow. We have to have accredited investors. If you are a credited investor, you can invest in one of our deals, and you are buying equity. The way it works is you are buying equity in an LLC. That LLC owns the particular real estate asset. We start at about $10,000 for a minimum investment. It ranges that we would have some minimum investments up to $30,000 and something like that.

We pull the investors together. They own the LLC, and the LLC owns the asset outright. There are many other ways that some crowdfunding is being done in the equity space but that’s how we structure these deals. We do that for a safety net. It’s great to have the investors invest in this LLC. The LLC owns the asset. At least there’s always this hard asset to hedge against the risk that helps mitigate our risk.

What is the asset? Are we talking about, “We own the land? We own the livestock. Do we own the crops?” Can you talk a little bit about what the asset is and how it’s structured?

The way we structure it is land. We are going out and looking for either raw, open land that can be developed into a vineyard or an orchard, something with a value add. We are looking at a vineyard or an orchard that is already existing that we purchase and the cashflow and the appreciation go to the investors.

We don’t have it structured to where investors are buying any depreciating asset, no tractors, things of that sort. We hire a farm manager or we will manage it ourselves through another company that we have. We have a farm management company where we manage the asset and farm the crops for the investors. Whatever is left after all the bills are paid is your cash yield.

This is out of our wheelhouse. I typically think of your improving an apartment or adding washer/dryers to apartment units. What is a value add if you are buying just the land and putting the crop on it?

Farming is a long-term investment play.

It’s interesting because it’s not as fast as a reward than say, buying an apartment. We are looking at buying an open piece of land. For example, in our last project, we bought some open land. We are developing it into a pistachio orchard. The orchard was planted here. You are looking at 5 or 6 years before you get a crop and 8 years before getting a full production crop.

You are looking at something. Let’s say I’m going to use roundabout numbers that you buy a piece of land for $15,000 an acre. You put $10,000 an acre into it. You are in it $25,000 an acre. That piece of property is now worth $40,000 an acre. That’s the value add. You are speculating in the sense that land is going to appreciate it.

In 7 or 8 years, this crop is still going to be a good crop and highly profitable but it has been very good in the ag space. That’s our value add. There are some other value ads where you can buy an existing vineyard that may need a well drilled or may not have enough water. You can add, you can bring production up and treat the ground better, put some better soil amendments in there and possibly get higher production. That’s also a value add.

What’s the life cycle of the investment? Are you mainly doing things like pistachios that take 7, 8 years to pay out or are there also cashflow options? Maybe you are doing a shorter-term thing like wheat. I don’t know much about farming, obviously. Are there different types of investments? When you say pistachios, I compare that to a development deal that takes a long time to payout, but at the back end, you have pretty good returns. Are there other things where you can cashflow immediately or sooner than that timeframe?

Yes. For example, we just closed on a walnut orchard that is in high production. It will have yearly payouts as soon as the crop is harvested and the income is received. We payout to the investors yearly. It all depends on what the investor wants. When you have a crop like this, your return on investment is usually a little bit lower than obviously developing and putting all this money out before the crop comes in. The most that we payout as far as timeframe goes is once every year. We harvest the crop once a year, then we will payout once a year.

What’s the typical hold on investment it would depend on whether it’s something that you bought already producing or if it’s something that isn’t? Is there a strategy known like ten years from now, then you sell? Is there a big upside and appreciation?

We like to hold on for about ten years. We will look at the market, say year 7 or 8 and year 11 or 12 possibly but our goal is for 10 years. We want to realize that appreciation. We want to buy a young orchard that is just on the cusp of production that has a long lifespan. When we sell it in year ten, let’s say the orchard is 14 or 15 years old and we can sell it for a premium, we realize that appreciation. We also can depreciate the orchard itself as far as the trees. There’s a large tax benefit for investors to buy an existing orchard, take the depreciation, and then capitalize on the appreciation over time.

Can you talk a little bit about how depreciation works? I didn’t know that you could depreciate the farmland. Does that work just like you would depreciate, do cost segregation or whatever, and get depreciation on a multifamily or is it different?

You can only depreciate the trees themselves that are planted on it or any structure like if there’s a barn or anything like that. I will use round numbers again. Say you paid $20,000 an acre for a piece of land that has producing trees. Let’s say the land is valued at $10,000, and you can depreciate that $10,000 an acre of trees and infrastructure that’s on there. Every state is different, and there are different Tax Laws and whatnot. We like to take as much of that depreciation as we can write off.

It’s good because, especially if you have a tax issue and it flows through on your K-1 that says, “I invested $10,000 but I have a $5,000 loss.” You can save that on your taxes, but yet you are still invested in a cashflow asset that should be giving you cashflow for the next ten years. That’s a big benefit that we like for already producing trees.

Do you finance these? Is there any financing available or is there no leverage at all?

We have a mixture, and it depends on the property itself, what our cashflow looks like. For example, in the last deal we just did, we are going to finance out 40%. We don’t like to do any more than 40% because, with agriculture, there are large swings in the income. It’s not as structured as an apartment. You know that you are going to get $100,000 a month, and your debt is $70,000 a month.

It’s a little bit different in ag because you have Mother Nature. You have on and off years or you will have high producing years and low producing years just to the genetics of the tree itself. We like to leverage everything about 40%. If that works out, it gets a little bit more return on investment and gets some cash back to the investors as well.

I have heard some big names that are investing in farmland like Bill Gates and some other big-time people. Why are they investing in farmland rather than other things? I get the sense that the returns might not be as stable. Are they generally higher returns than you would get investing in some standard real estate as we might do?

Farming is a long investment play. Over the long-term, farming has done 11%. It’s the number that they came up with that farming has returned. The larger institutional investors and these wealthy billionaires see the writing on the wall. Most people think inflation is coming. We have printed an inordinate amount of money.

Once that really hits our economy here, hard asset inflation, which we have already seen in housing and different things and apartments, we are just starting to see it in farming. When you buy a piece of land for $10,000, and you hold onto that piece of property and that commodity, let’s say it’s corn, and corn is $4 a bushel. As inflation hits, it’s up to $14 a bushel. It makes it quite a cheap asset. It’s a great inflation hedge. That’s the largest region these guys are parking money inland.

What types of crops? You have mentioned a few. As far as if we are going to go on onto the FarmFundr website and invest in a few, what would we see there? How do you differentiate between which is a better investment, which is going to pay higher returns, quicker returns or slower returns? How do you figure all that stuff out?

We mostly deal with permanent orchards or vineyards. We like the nut crops, something that can be stored. It’s not perishable. That way, you can ride out market instability. We have seen this happen before with cherries or stone fruit and things of that sort, which are highly perishable. If you don’t move it at a certain time, you lose the market.

There are a lot of risks there. We like contracted vineyards mostly because we can get a higher return. What we have not been doing is some of the Midwestern type leasebacks where you buy a piece of property, say for $12,000 or $13,000 an acre, you lease it back to a farmer for a structured 2% or 3% return, and then expect a 4% appreciation and claim a 7% return. I haven’t been doing any of that.

I’m not saying that that’s not realistic because appreciation has been there. It’s not something that we are banking on. We like the high return potential for these permanent orchards. We would like to beat that 8%, 10% return on investment possibility. Obviously, we don’t know what’s going to happen. Our goal is to get a little bit higher of a return. By doing that, we are farming this land for the investors instead of doing a leaseback. There’s also added risk. You get a higher return but you also have the possibility of a crop loss where you don’t get a return. You play that risk-return type of deal.

You mentioned contracted vineyards. What is that?

You can contract your wine grapes with a winery. You can contract us out for 5, 10, 15 years. They will take of your wine grapes. You can contract out your raisins over here in California where you have a set price or you know within reason what the price is going to be, things where it helps hedge against the infrastructure you put in. A vineyard is very expensive to put in. We want to know that we have a home for it. We are not going to be out on the open market. We want to know that within reason, our production will pay for the infrastructure and the land that we purchase and give us a decent return.

Does that mean the grapes, you are growing them and are basically already sold? You are not worried about the perishable part of it like you are with the cherries. Is that the difference?

Yes.

You want to be careful of what’s being offered out there and make sure it’s something that fits your personal beliefs. You want to make sure that it’s a true investment.

Talk about the risks. You mentioned something about not getting a crop that year. Could there be a couple of years where none of the walnuts grow or some drought happens, or something happens where there’s absolutely nothing in the crop, or is it just some years are better than others?

Some years are better than others. It would take a catastrophic event like a hail storm or some issue, whether it be weather or pest, to really hurt that orchard. I’m not saying it’s possible. We do try and mitigate that by checking weekly for our pest populations. We are insuring the orchard with crop insurance. That way, if there is a loss, we cover all of our cultural costs to produce that crop. We do mitigate that risk as much as we possibly can. Very unusual to have a complete crop loss. I can’t say it’s never possible but it’s very unusual.

I have been hearing almonds have had a bad reputation because of the water use. I saw somewhere that that might not be as accurate. They are making almond milk. They are making coconut milk, oat milk, all these different kinds of milk. My question is, are almonds bad for water or has there been a change in that?

When crop starts to take off here in the State of California, for whatever reason, it becomes the bad guy. For a long time, it was cotton. Cotton uses so much water. Cotton doesn’t use very much water at all. Almonds use a lot more water. There are also certain corn crops and alfalfa crops that use a lot more water than in almond crops.

Another thing is when you irrigate an almond tree, you produce nuts. You produce leaves. You produce all kinds of different things. Not to mention, you put water back into the aquifer as it goes down past the root zone. There are many benefits to farming these trees. I hate to say that they get a bad rap at all. I just don’t believe it to be true. If California didn’t have all these almond trees or crops planted, it would probably not be a very fun place to live as far as the valley fever and the insects that are out of control. They are a good crop and they don’t use as much water as a lot of other crops.

How did the pandemic affect farming?

It was very crop-specific. For example, the milk price fell drastically because kids didn’t go to school. There wasn’t a school lunch program, and they weren’t serving the milk. It’s funny the way things you don’t think of. Most lemons are used in restaurants. When they closed the restaurants, the lemon price fell. It bounced right back up, and demand was out of control. It’s funny how each crop specifically either had a bounce-back or got held back. Overall, I would say the pandemic was not good. Every crop got devastated for the first 6 to 10 months of the pandemic. In 2021, we were really seeing these crops bounce back. In 2022, it will probably see a record year for crop prices.

Is that because of inflation or just because, coming back from the pandemic, people are buying more now and getting back into hopefully normal life?

I think it’s both. Inflation is really starting to hit. When fuel prices go up, that affects farming, obviously from tractors in the field, the fertilizer that’s made from petroleum. There’s not much you do in farming that that is not affected by fuel prices. That’s huge, but then I also think the demand is there and is stronger than ever.

I would like to pivot here and talk about how as an investor, I can analyze a deal, an operator or the water, the soil. How do I know if I’m going to invest in a farm operation? How do I know which operators are better than others? We have tools to analyze multifamily apartments and all those things because that’s what we are used to. If we are getting into a farm, how do I vet the operator and make sure they know what they are doing?

I think you want to look at history to see what they have been farming, how long they have been farming, and make sure that whoever this operator is has a good track record. The farming community as a whole is very small. You wouldn’t believe how many people know each other. As far as vetting that particular operator, the more you dig in, you would be able to find out whether they are a good actor or a bad actor. That’s important to see their history.

When you are looking at the asset itself, farmland, like apartments, there’s A, B, and a C. In farming, we have 1, 2, and 3 types of soils. You want to look at their soil and see what crops are being planted on that soil. Make sure it’s correct and that the production is what it’s supposed to be. When you look at a crop, and you are going to buy something, you can look at the history if the crop is producing.

You can see what it produced the year before and know within reason what it should produce in the following years. When you are looking at any real estate asset, and you look at past appreciation, future appreciation. You look at interest rates and things of that sort. That’s a big one. You want to make sure that the income that that farm is producing is going to be representative on average what the price you are paying for that asset.

The big thing for us is I have seen some pretty high appreciation rates. I’m not saying that’s wrong because there has been some high appreciation on some crops and whatnot. I would be wary if you look at something, and it says it has a 6.5% appreciation rate over ten years or something like that. You might want to back that out to something realistic. Those are things that you would look at that would be very similar to looking at other assets.

If we are investing through FarmFundr, they are your deals. You have already vetted them. You are probably operating them. The information you have talked about as far as how to figure out and analyze those deals, is that all there for us to view, including financials and pro forma and that type of thing?

Yes. Before anything goes on the site, we have already vetted that particular piece of property and looked at what past production is or what future production could be. We are looking very hard at water, water rights, what’s available, the wells as far as surface water, which there could be water stock that’s owned by the canal that comes down and irrigates. We look at all those things to make sure that in the future, it’s going to have enough water during drought years.

We are famous for our droughts out here. We want to make sure that if we are in a five-year drought, there is still water for this particular piece of property. We vet all these pieces of property and crops to make sure that it is a good investment. We are pretty picky. I have seen some other deals out there that came across my desk that we have gladly passed on that have been out in the internet world. We only want stuff that has true profit potential.

Are you primarily in California or are there other places that you are buying farms as well?

All of our deals have been in California. We have looked at deals in Arizona, Washington and Oregon. We haven’t found anything that we have liked in those states yet. We have gotten really close to some stuff in Arizona but there were some water issues that we didn’t like. We decided not to offer it. They were a little unknown. We are not opposed to any geographical area. We want to make sure that all the stars align for the investors before putting anything on the platform.

If you invest in something that’s not near where you are if you were to go out of state, do you hire managers there that have already been doing that? Do you have your own people that go out there?

We would vet a farm manager and make sure that they are the right person to manage that farm.

If I’m an investor and I don’t know much about farming but I want some exposure to farming, we are relying on you, FarmFundr, as the manager to select some investments and put them on your platform. I can choose, “This one or that one looks good.” If you have three investments up there, how do I decide which one is best for me?

There’s a personal aspect to it. There are some people who don’t want to invest in walnuts but may want to invest in pistachios just because they like the way they taste. They may want to invest in almonds because they love almond milk. At the end of the year, we send out a portion of the crop to our investors that invested in it.

We will send almonds out to everyone invested in the almond orchard. Not a lot, but just something, so everyone gets to see, “This is what we did, and this is what you grew.” That’s part of it. You want to look at the return. You may look at something and say, “This 8.5% or 9% return is not really what I want. It’s only $10,000. I want to risk a 12%, even though it’s a little higher risk.” There’s a personal preference to that.

Do you have past returns that we can look at? If it’s an almond farm, can I see that you have done an almond farm before, and the returns have typically been 5% or 10% or whatever? Are those even comparable? Can you compare one farm to another, even if it’s the same crop?

It’s hard to compare one farm to the other because there are many different variables. For example, you can go 2 miles away and pay $21,000 an acre for an almond farm and then 2 miles in the other direction, it’s $38,000 because of the higher return and what these trees in the ground are producing. You have to get a long track record. We’ve now got our second year on some of these investments, which are coming through the pandemic, which is funny. You want to compare over a larger five-year. You can have a 20% return and then a 1% return. That’s very common in the agricultural world. You want to look at it over time.

If the minimum is $10,000 and you have $50,000 to invest, it might make sense to do five different investments rather than go all-in with one because you are smoothing out the results. If you have a 20% year and a 1% year, maybe the other farm is on the opposite schedule. You can smooth out your returns a little bit. Do you co-invest in these farms? Are you investing in the farms as well?

We usually invest in every farm.

That is one thing that we look at when we are talking to sponsors. Regular real estate is to have some skin in the game from the sponsor. Can you also talk about what type of fees are there? Are there management fees, asset management fees, property management fees? I don’t have a concept of what the fees might be.

FarmFundr charges a 1.5% fee on the capital that’s raised, and that’s yearly. We have a management fee for the farmer, which is roughly $150 or $160 an acre for the year. It depends. Those fees can go up or down depending on the crop type and the size of the ranch, the size of the farm, if it’s in-house or if it’s another farmer that’s managing it. Those are pretty much the only two fees. There are some legal fees, cost of capital if we borrow money, but not a lot of fees.

Before I get to our last question, because this is such a new asset class for me and for most of us, is there anything else we should know about FarmFundr or about farming if we are looking to invest?

You want to be careful of what’s being offered out there. Make sure it’s something that fits your personal beliefs or wants. Make sure that it’s a true investment. It’s a true return that they are offering. For example, you may want to invest in organic. Make sure that whoever’s offering these things, that the farms are able to be certified organic, that they are not blowing smoke at you.

This has been very interesting. I don’t have a whole lot of experience with this, so we are on a learning journey. The last question I generally ask is, if you are a podcast person, what’s a great podcast that you listen to, whether it’s farming-related that we might like or real estate-related?

I used to be a podcast person. About a few years ago, I started just getting into audio. I have been on an audiobook kick. I have listened to all kinds of different audiobooks, but I honestly have not been listening to podcasts in a while.

Can you give us a good audiobook? It’s not much different.

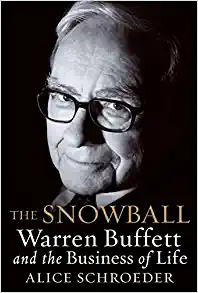

I’m trying to think of the last couple that I have listened to. The last one I finished was that long 35-hour on Warren Buffett. The Snowball was the name of it. It was a very long book. It was literally like 30 hours or something. It was about his life and journey and things about that. It’s interesting, actually.

I’m going to have to check that out. I’m a Warren Buffett fan. That’s interesting. How can our readers get in touch with you if they want to invest or just find more information? What’s the best way to get in touch with you?

The best way would be to go to the website at FarmFundr.com. You can email us at Info@FarmFundr.com. We are here to answer any of your questions.

Thank you very much. This was fascinating. We appreciate you being on the show.

I do appreciate it.

—

That was interesting having that conversation with Brandon. You could tell I don’t know much about farming, but you’ve got to start somewhere. You’ve got to start learning. I was interested to hear it’s accredited. A lot of the crowdfunding websites you can get on there with are non-accredited but the minimums are $10,000. That means you can take $30,000 and get into three farms and spread out your risk a little bit. As he talked about, sometimes there might be low years of yield, and sometimes there’s great yield. To spread it out seems to make a little bit of sense.

I also thought it was interesting that you could have value add on land. It makes sense. You put structures on it. You can increase the water. You do stuff to the soil. I was also pleased that there was depreciation. When I think of depreciation, I always think we can’t depreciate land. You put things on the land like trees or buildings, and you can appreciate that.

There are tax benefits to this. It’s also low leverage, which sometimes is good. Most of our investments are pretty high leverage. To have some that are totally different with low leverage in a different asset class, I like that as well. I was also personally and selfishly pleased to find out that I can start drinking almond milk again. I had switched to coconut milk, thinking that it takes up too much water. I’m glad that got figured out. The last thing is, we say sometimes the reason I like investing in apartments is everyone’s got to have a place to live.

If that’s true, everyone’s got to eat. Why aren’t we investing more in farmland? It’s probably because we have thought the returns weren’t adequate. There aren’t big enough returns. If people like Bill Gates are investing in it, maybe it’s worth checking out. Maybe it’s worth going to FarmFundr and seeing what the returns actually are. You can start small. You can put a little bit in there and just try it out and see how you like it. That’s definitely something I’m going to consider. I want to get into farming. This might be the way to do it. We will see you next time on the Left Field.

Important Links:

About Brandon Silveira

Brandon graduated from California Polytechnic University San Luis Obispo with an agricultural degree. After graduating, Brandon started his career in the agricultural industry, and has experience managing and farming a large variety of crops.

Brandon graduated from California Polytechnic University San Luis Obispo with an agricultural degree. After graduating, Brandon started his career in the agricultural industry, and has experience managing and farming a large variety of crops.

Brandon has bought and sold millions in real estate and currently manages over $100 million in assets. His farm management company was recognizing in 2012 for achieving over 900% growth, and was listed on the “INC. Magazine” list of fastest growing companies at number 701. It was the only agricultural company on the list.

Brandon’s specialty is in farm management, land acquisition and a variety of farm and land financing and strategies. His passion is to help bridge the gap between the agricultural industry and the consumer.

FarmFundr investors can rest assured they are gaining access to deals selected by a professional that has a demonstrated history of thriving in the farming industry.

Our sponsor, Tribevest provides the easiest way to form, fund, and manage your Investor Tribe with people you know, like, and trust. Tribevest is the Investor Tribe management platform of choice for Jim Pfeifer and the Left Field Investors’ Community.

Tribevest is a strategic partner and sponsor of Passive Investing from Left Field.